Performance and Governance

Find out how we approach governance, meet our Board, dive into the detail of our performance, and check our financial results.

- Results

- Governance

- Leadership

- Bonds

Results

- 2024

- 2023

- 2022

- 2021

- 2020

- 2019

- 2018

- 2017

- 2016

- 2015

- 2015-Archive

- 2014

- 2013

- 2012

- 2024

-

Archive

- 2021

- 2020

- 2019

- 2018

- 2017

- 2016

- 2015

- 2015-Archive

- 2014

- 2013

- 2012

- 2024

Announcements |

Results Presentations |

Financial Statements |

Investor Call |

|

|---|---|---|---|---|

| Q1 |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

| Q2 |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

| Q3 |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

Announcements |

Results Presentations |

Financial Statements |

Investor Call |

|

|---|---|---|---|---|

| Q1 |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

| Q2 |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

| Q3 |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

| Q4 |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

Announcements |

Results Presentations |

Financial Statements |

Investor Call |

|

|---|---|---|---|---|

| Q1 |

Download PDF

|

Download PDF

|

Download PDF

|

Watch

|

| Q2 |

Download PDF

|

Download PDF

|

Download PDF

|

Watch

|

| Q3 |

Download PDF

|

Download PDF

|

Download PDF

|

Watch

|

| Q4 |

Download PDF

|

Download PDF

|

Download PDF

|

Watch

|

Announcements |

Results Presentations |

Financial Statements |

Investor Call |

|

|---|---|---|---|---|

| Q1 |

Download PDF

|

Download PDF

|

Download PDF

|

Watch

|

| Q2 |

Download PDF

|

Download PDF

|

Download PDF

|

Watch

|

| Q3 |

Download PDF

|

Download PDF

|

Download PDF

|

Watch

|

| Q4 |

Download PDF

|

Download PDF

|

Download PDF

|

Watch

|

Announcements |

Results Presentations |

Financial Statements |

Investor Call |

|

|---|---|---|---|---|

| Q1 |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

| Q2 |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

| Q3 |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

| Q4 |

Download PDF

|

Download PDF

|

Download PDF

|

Watch

|

Announcements |

Results Presentations |

Financial Statements |

Investor Call |

|

|---|---|---|---|---|

| Q1 |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

| Q2 |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

| Q3 |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

| Full Year |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

Announcements |

Results Presentations |

Financial Statements |

Investor Call |

|

|---|---|---|---|---|

| Q1 |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

| Q2 |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

| Q3 |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

| Full Year |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

Announcements |

Results Presentations |

Financial Statements |

Investor Call |

|

|---|---|---|---|---|

| Q1 |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

| Q2 |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

| Q3 |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

| Full Year |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

Announcements |

Results Presentations |

Financial Statements |

Investor Call |

|

|---|---|---|---|---|

| Q1 |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

| Q2 |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

| Q3 |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

| Full Year |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

Announcements |

Results Presentations |

Financial Statements |

Investor Call |

|

|---|---|---|---|---|

| Q2 |

Download PDF

|

Download PDF

|

||

| Q3 |

Download PDF

|

Download PDF

|

Listen

|

|

| Full Year |

Download PDF

|

Download PDF

|

Download PDF

|

Listen

|

Announcements |

Results Presentations |

Financial Statements |

Investor Call |

|

|---|---|---|---|---|

| Q1 - Archive |

Download PDF

|

Download PDF

|

||

| Q2 |

Download PDF

|

Download PDF

|

||

| Q3 |

Download PDF

|

Download PDF

|

||

| Full Year |

Download PDF

|

Announcements |

Results Presentations |

Financial Statements |

Investor Call |

|

|---|---|---|---|---|

| Q1 |

Download PDF

|

Download PDF

|

||

| Q2 |

Download PDF

|

Download PDF

|

||

| Q3 |

Download PDF

|

Download PDF

|

||

| Full Year |

|

Download PDF

|

Announcements |

Results Presentations |

Financial Statements |

Investor Call |

|

|---|---|---|---|---|

| Q1 |

Download PDF

|

Download PDF

|

||

| Q2 |

Download PDF

|

Download PDF

|

||

| Q3 |

Download PDF

|

Download PDF

|

||

| Q4 |

Download PDF

|

|||

| Full Year |

|

Download PDF

|

Announcements |

Results Presentations |

Financial Statements |

Investor Call |

|

|---|---|---|---|---|

| Q2 |

Download PDF

|

Download PDF

|

||

| Q3 |

Download PDF

|

Download PDF

|

||

| Full Year |

|

Download PDF

|

Announcements |

Results Presentations |

Financial Statements |

Investor Call |

|

|---|---|---|---|---|

| Q1 |

Governance

We take governance extremely seriously. Our reputation depends on it.

Commitment to transparency

We fulfil our legal and regulatory requirements everywhere we operate.

-

Customers in Vulnerable Situations (CIVS)

Our definition of a customer in a vulnerable situation is ‘someone who, due to their personal circumstances, is especially susceptible to detriment, particularly when a firm is not acting with appropriate levels of care.’

Read about our approach to Customers in Vulnerable Situations.

-

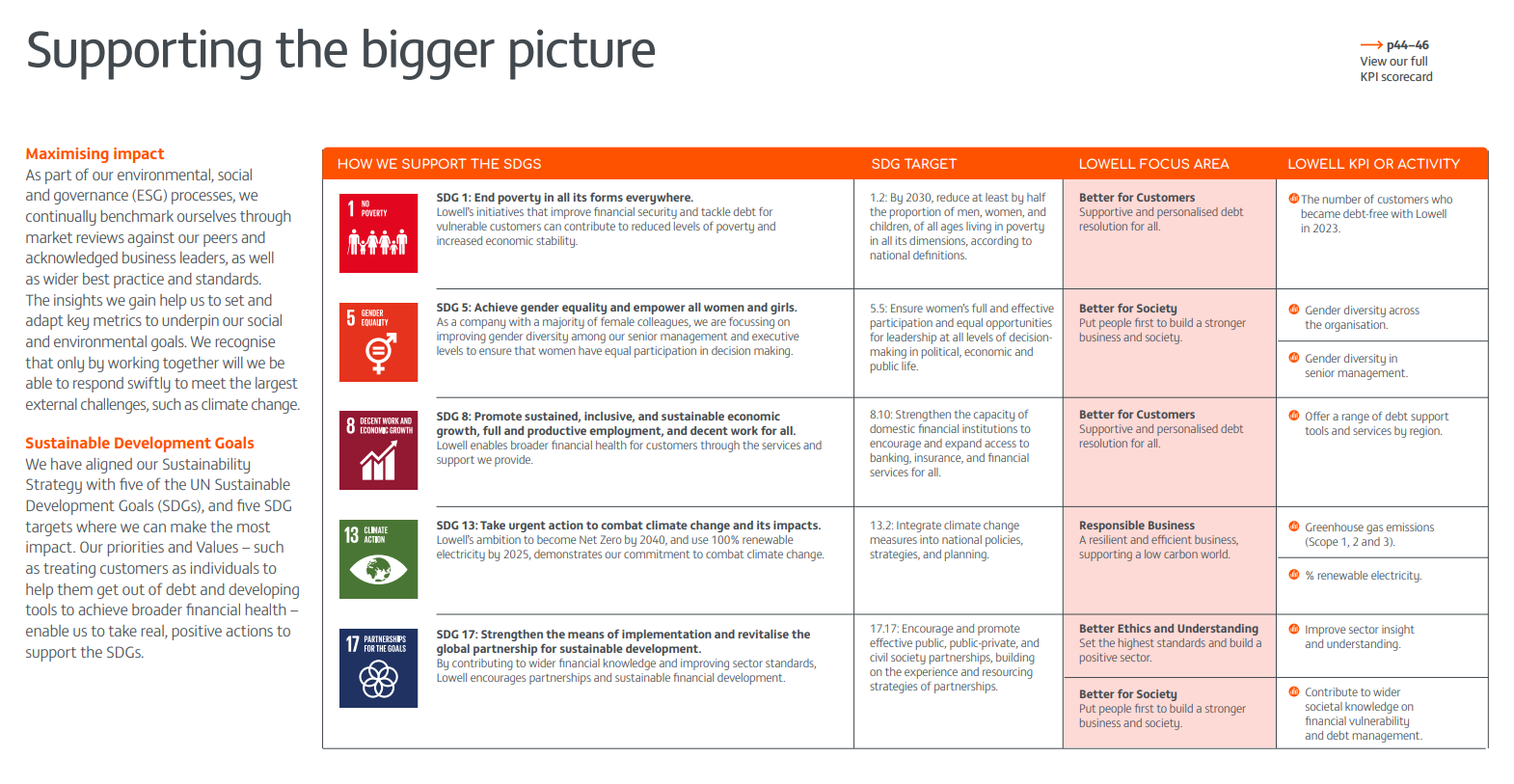

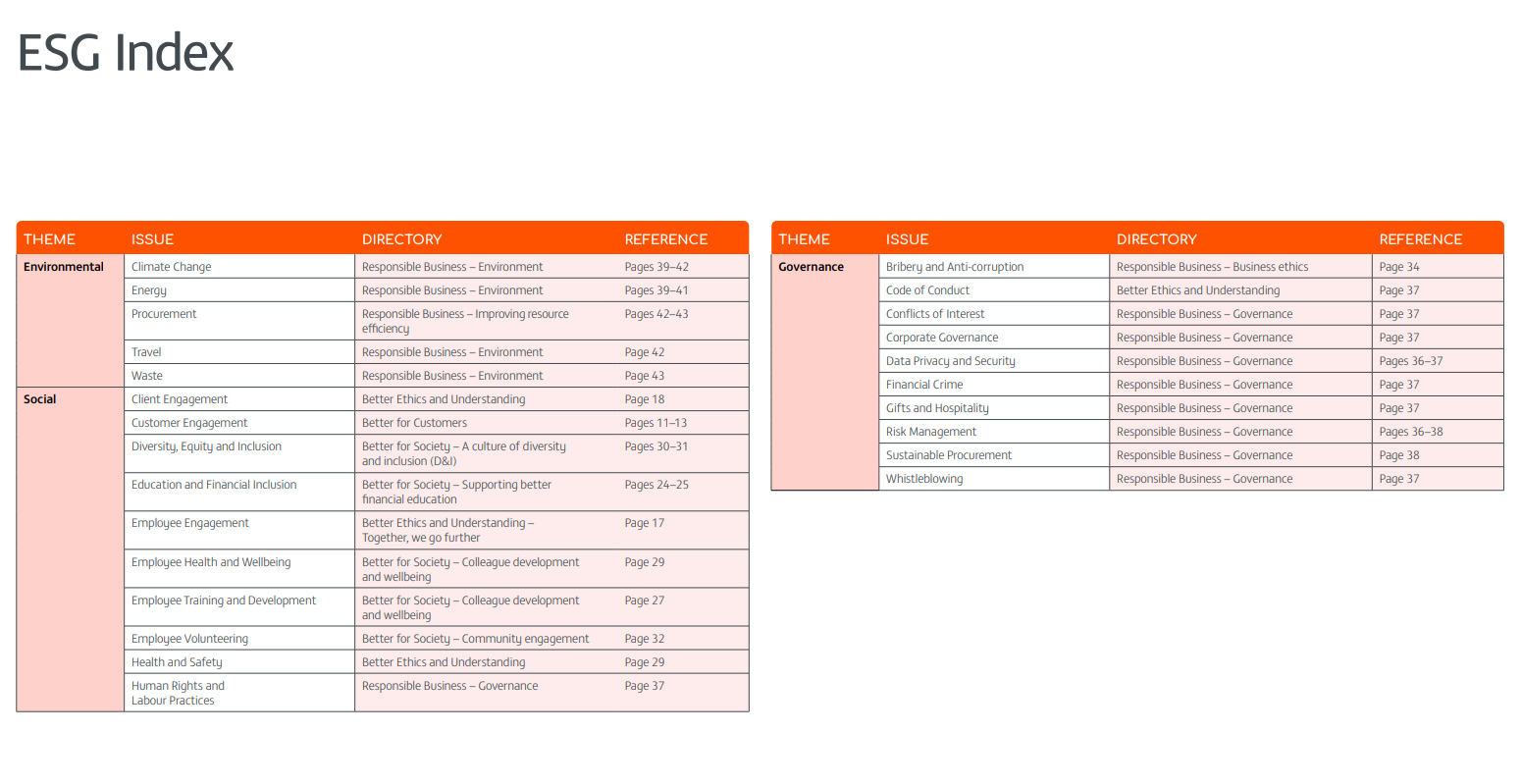

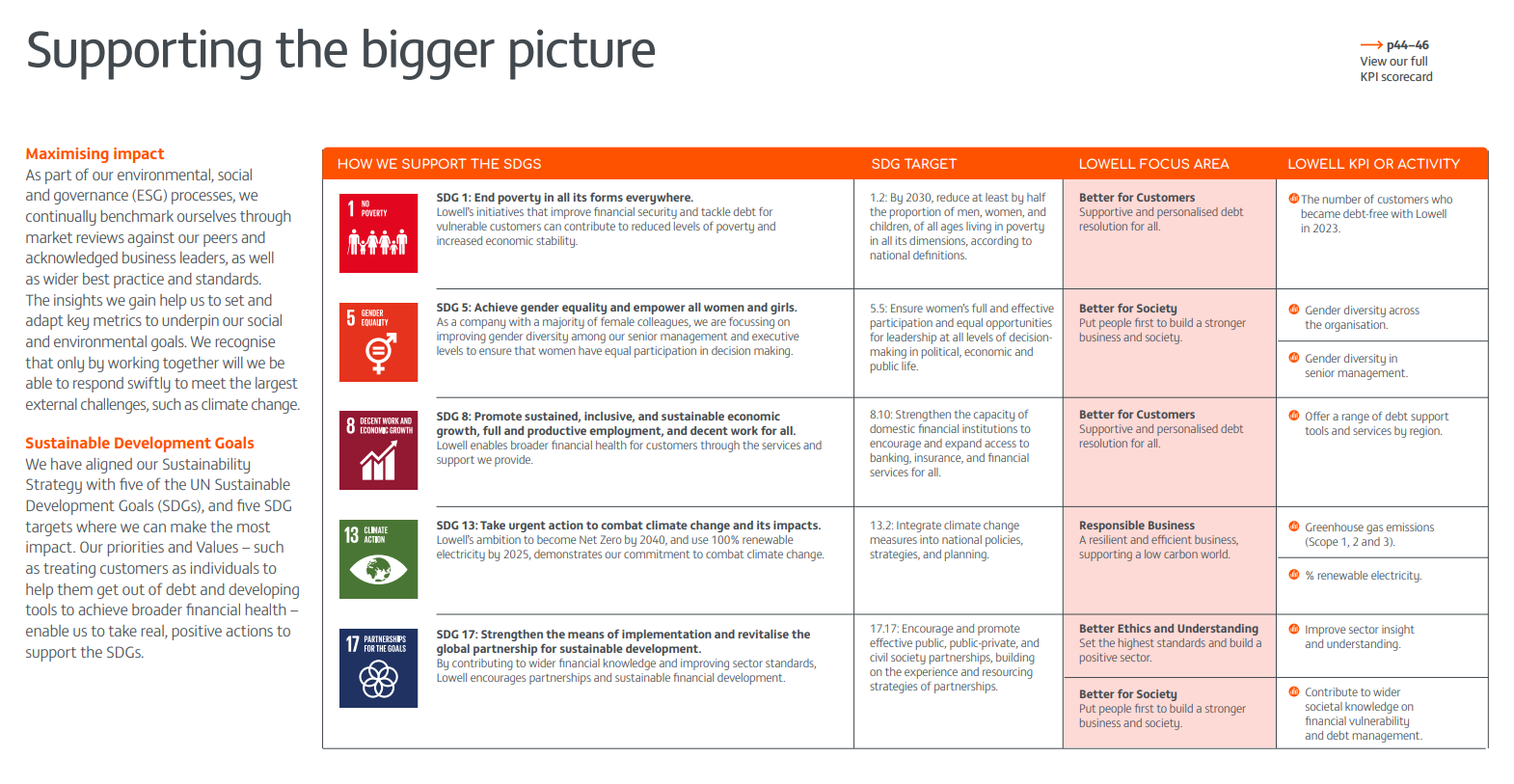

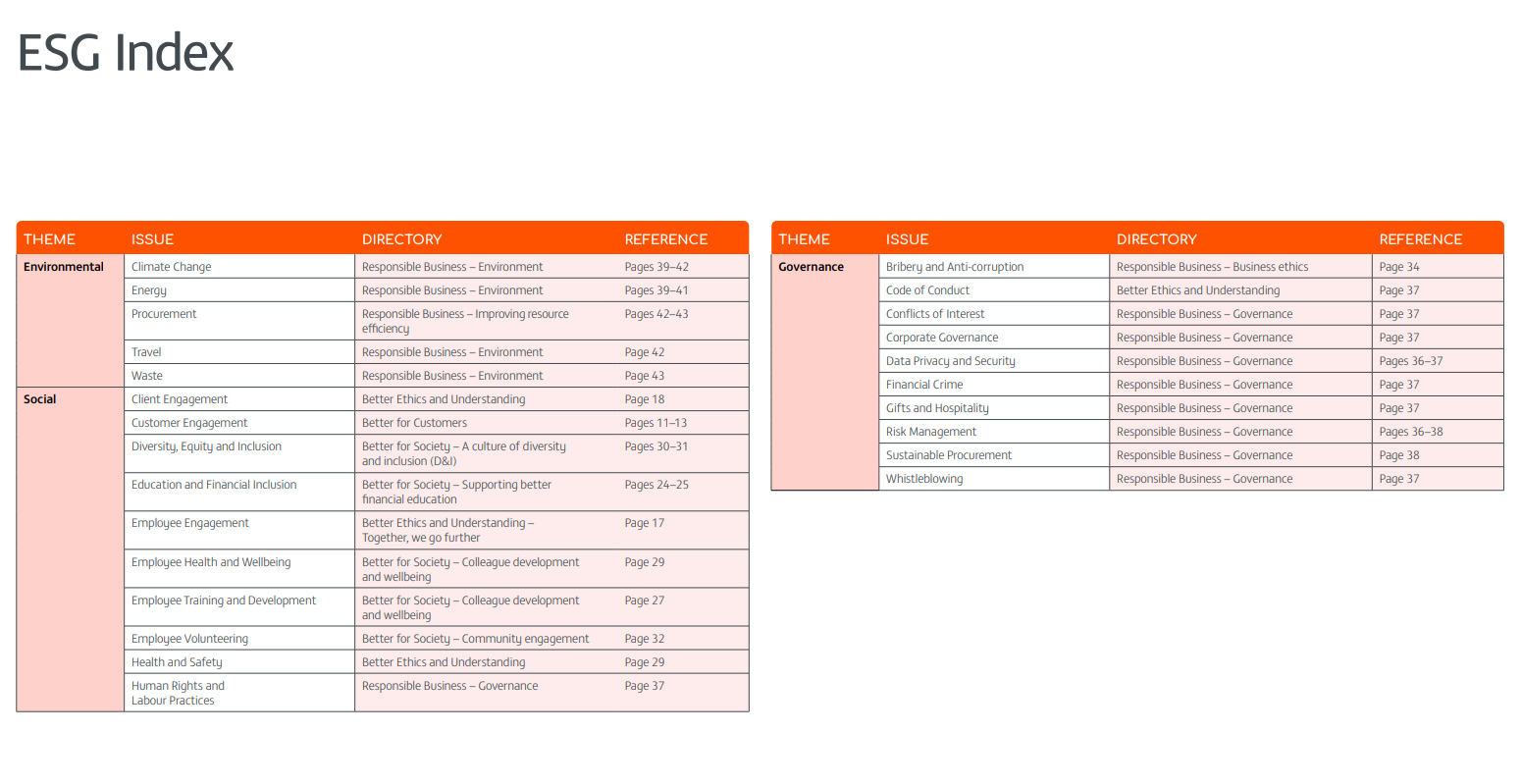

Sustainability strategy

Read our Sustainability Report 2023 for information about the non-financial measures, policies, and proof-points within our sustainability strategy.

Visit the Sustainability pages for details of the strategy and its components.

-

Diversity, Equity, and Inclusion (DEI)

Our DEI vision is to develop a culture where colleagues can be themselves and feel they belong; where they can fulfil their potential in an environment that values and embraces their uniqueness. This approach is helping us build a strong, passionate workforce where everyone can be their best: for themselves, for our customers, and for our clients.

We see diversity in its broadest sense, as all the visible and invisible differences that make us unique: life experience, background, religious and cultural differences, age and gender and sexuality, physical abilities and neurodivergence.

We believe that by making people aware of the value of inclusivity, we’re giving them the courage to dare to do things differently.

We have six clear DEI commitments:

- We believe it takes diversity of spirit, culture, background, experience, and perspective to make credit work better for all.

- We want Lowell to be a community where everyone is free to be themselves, feels welcome and that they belong.

- We are committed to raising awareness of the importance of diversity and creating an inclusive culture.

- We recognise that we do not all start from the same place and that we must make adjustments to address imbalances.

- We know this will drive innovation and improve what we do for our customers, clients, and the communities we operate in.

- We are proud to be building a sense of belonging that goes beyond any role, business unit, country or culture and unifies us as One Lowell.

You can read more about our DEI initiatives and progress in our Sustainability Report 2023.

-

The gender pay gap

The gender pay gap is the difference between the average hourly pay for all the men and women working at the same organisation. It’s not a measure of equal pay, which is about the pay a man and a woman receive for doing the same or similar job.

We have a pay and grading structure for all employees, and we use market-benchmarked rates for all roles. We also have robust processes to make sure we review pay fairly for all employees.

Our annual Gender Pay Gap in the UK report explores our progress towards a more balanced distribution of men and women across all levels of Lowell UK.

See our UK Gender Pay Gap report 2024.

-

Section 172 Statements

Our directors are committed to acting in the best interests of our business. In compliance with Section 172 of the Companies Act 2006, the following statements reflect that commitment in respect of our UK registered companies for 2022:

-

Tax strategy

We pay the necessary taxes in the countries in which we operate. Our statutory obligations within the UK are covered in our 2024 statement.

Read our 2021 statement, 2022 statement, or 2023 statement.

-

UK complaints reporting

Every six months, we report on the number of complaints the Financial Conduct Authority receives about us. You can download our latest figures (H1 2024).

-

UK Modern Slavery

Read our 2024 Modern Slavery statement to see how we apply the Act throughout our business.

View our 2023 Modern Slavery statement.

-

UK Women in Finance Charter

Our UK business is a signatory of the Women in Finance Charter.

We’ve been working towards Lowell’s group-wide target of 40% female representation in our senior team by the end of 2025. We are delighted to report that Lowell UK reached this target in August 2024, reaching 41% female representation in the senior team. This is a 13% increase since we first set our target in December 2020.

Our Code of Conduct

Our reputation stems from our fundamental principles of honesty, integrity, and trust. It’s a reputation everyone at Lowell plays a role in keeping. Our Code of Conduct sets out how we work as a company – what we expect from our colleagues and the ethical behaviours we ask everyone at Lowell to adopt.

Read our Code of Conduct.

Our approach to governance

Good corporate governance is fundamental to how we create and build sustainable value for internal and external stakeholders.

See a summary of our approach to governance.

Our approach to human rights

We have a responsibility to advance respect for human rights in our business and throughout our value chain. Our Human Rights Policy outlines our commitment to respecting human rights. This means treating our colleagues, suppliers, clients, customers and communities with respect and dignity.

Read a summary of our Group Human Rights Policy here.

Our approach to managing suppliers

All Lowell suppliers are required to comply with our Supplier Code of Conduct which is referenced in our contractual terms and conditions.

Guided by our regulatory framework, including the German Supply Chain Due Diligence Act, we place utmost importance in the respect of human rights in our own business and our supply chain. See our rules of procedure applicable to German based suppliers and those supplying services to Germany, together with the applicable complaints process here.

Our approach to risk

We protect our customers, colleagues, business, investors, and society, while enabling sustainable growth. We do this through informed risk decision-making and robust risk management, supported by a consistent risk-focused culture.

Find out more about how we deal with risk.

Committees’ responsibilities

Collective responsibility for the strategy and the delivery of sustainable value to shareholders rests with our Investor Board, which is responsible for:

- The long-term success of the company.

- Deciding overall Group strategy.

- Approving major investments and contracts, transactions, and other financial matters.

- Progressing commitments to sustainability.

- Monitoring the progress of the Group against budget.

Our Executive Committee oversees our operations, supported by our key governance committees.

These committees, and the individual business sub-committees, make sure we follow rigorous and consistent governance processes across all our activities:

Group Audit Committee helps in the management and disclosure of the Group’s financial affairs.

Group Risk Committee gives oversight and advice on risk exposure, strategy, appetite, and tolerance.

Group Remuneration Committee approves reward policies, making sure their design promotes the long-term success of the Group.

Regional Risk & Control Committees ensure the regions manage their risks in line with Lowell’s Risk Framework and in compliance with local regulations.

Group Sustainability Committee is an exceptional instrument of governance in our sector: only 13% of FTSE 100 non-banking financial service companies have a comparable Board-level committee. It gives strategic advice, leadership, and challenge to the Board about Lowell’s sustainability agenda, and sets our appetite and ambition thresholds at a Board level.

Data protection and information security

Our customers and clients trust us to store, manage, and process their data safely. They don’t give us their trust; we must earn it. We do this through our everyday actions and by being completely transparent about our commitments. People can get a sense of this through the privacy assurances that we publish on our websites.

Each region has its own Data Protection Officers and a dedicated Information Risk team responsible for ensuring the business meets its data protection obligations. A lawyer specialising in data protection law heads each team. They each report to the regional Chief Risk Officer as part of the second line of defence in our governance model.

We have comprehensive policies covering:

- Data governance

- Data protection

- Information security

- Information classification

- Data handling

- Information retention

- Cyber security

Cyber-attacks are a constant threat to all businesses

We take a proactive approach to cyber security, managed by our in-house team of cyber threat experts and overseen by the Group Chief Finance Officer, who has an IT background. A member of the Executive Management team oversees our cyber security strategy.

Read about how we protect data.

Group Executive Team

-

Colin Storrar

Group Chief Executive Officer

Colin Storrar

Group Chief Executive Officer

Colin became Group CEO on 10th June 2019, having first joined Lowell as Group Chief Financial Officer in 2013.

Previously he was at HSBC Bank PLC, where he managed a multi-billion pound asset base for both First Direct and HSBC’s contact centre and digital channels. Before joining HSBC, Colin held a number of senior roles with GE Consumer Finance, and has extensive audit and consultancy experience with Arthur Andersen and Deloitte.

Colin is a Qualified Chartered Accountant, and holds a Bachelor of Arts degree in Modern History from the University of Leeds, and an MSc in Economics and Economic History from the London School of Economics. -

Jamie Wilson

Group Chief Financial Officer

Jamie Wilson

Group Chief Financial Officer

Jamie joined Lowell in March 2020. He has wide senior leadership experience, most recently as Executive Vice President and Chief Financial Officer of Avon Products Inc. Before that, he spent over a decade in senior roles at SABMiller, latterly as Chief Finance Officer and a Main Board Director.

Having gained a degree in Law from Edinburgh University, Jamie started his career as a trainee accountant & corporate tax manager, qualified as a Chartered Accountant and joined the finance team at Highland Distillers, before being appointed MD of Highland Malt Distilling. He continued to build his career in the drinks sector, by working within Remy Cointreau and Scottish & Newcastle PLC, before joining SAB Miller PLC. -

Eva Eisenschimmel

DACH CEO

Eva Eisenschimmel

DACH CEO

Eva is Chief Risk, Reputation, Strategy & Sustainability Officer at Lowell, having previously held the position of Chief of Staff for 5 years. She is a senior Executive with an impressive track record in organisational transformation, marketing, and customer experience.

Previously, Eva was MD Telephone and Digital Banking then Group CMO & Culture Director at Lloyds Banking Group, Chief Operating Officer & CMO at EDF Energy, VP Europe at Allied Domecq, Head of Relationship Marketing at British Airways, Commercial Director Europe for Häagen-Dazs, as well as co-founding her own digital marketing agency early in her career.

Being a values led person, Lowell’s mission - to “Make Credit Work Better for All” hugely inspires her. She says, of her career: There are three common threads that bind my experience. Great brands, customer focus and great people.

Eva is also a Non-Executive Director & Remuneration Committee Chair at Saga plc and has held NED positions with First Utility, Water Plus and Virgin Money. -

Bitte Ferngren

Group Chief People Officer

Bitte Ferngren

Group Chief People Officer

A law graduate of the University of Stockholm, Bitte joined the Group in June 2020 from Scandic Hotels, where she was Senior Vice President Group HR and Sustainability. Before that, she spent four years as HR Director for Royal Sun Alliance Scandinavia and previously served in various roles with TeliaSonera. Bitte has experience of working across multiple countries, has financial services experience, and has been responsible for driving people transformation with companies of similar size to Lowell. -

John Pears

UK CEO

John Pears

UK CEO

John joined Lowell in May 2018 bringing over 18 years of credit management, operations and risk experience to his role as UK Managing Director. John’s career spans across global financial firms, including Bank of America, MBNA Europe Bank Ltd and most recently as Credit Risk and Operations Director at Shop Direct. John has a BA (Hons) in Geography from Liverpool University. -

Johan Agerman

Nordics CEO

Johan Agerman

Nordics CEO

Johan joined the Group in March 2019 as Managing Director of our Nordic region, he was appointed CEO of our Nordics and DACH regions in March 2023.

Johan has an extensive career at senior management level, including serving as the CEO of Länsförsäkringar AB. Before that, he was the CEO of Trygg-Hansa, the Swedish brand RSA Insurance Group, where he also held various roles including IS & Change Director and CIO.

His experience as an industry expert is highly valued and utilized by the Swedish Royal Institute of Technology, where he is supporting a PhD student and two professors on their thesis.

Johan holds a BSc in Business Administration from Uppsala University, and has participated in the Advanced Management Programme at Stockholm School of Economics. He also served as a Naval Officer at the Swedish Naval Academy. -

Kevin Blake

Group Chief Risk Officer

Kevin Blake

Group Chief Risk Officer

Kevin has worked in senior leadership roles in banking and finance for over 30 years. He graduated from the University of West London with a 1st Class degree in Business Studies before joining the Barclays Bank graduate scheme, where he focused on corporate and commercial banking.

Over the last decade he’s specialised in CRO roles, including some years in Ireland where he managed the de-leveraging of two nationalised banks alongside KPMG. He returned to the UK as CRO for a PE-backed mortgage servicing business. Following its sale to Arrow Global, he became its European Risk and Compliance Director before joining Lowell in December 2020 as UK Chief Risk Officer.

Investor board

-

Andy Green

Chairman

Andy Green

Chairman

Appointed: October 2019

- Expansive, global non-executive career

- Previous CEO and Executive Board level roles at BT Group plc and Logica plc.

- Diverse industry experience including Telecoms, IT, Humanitarian Relief, Space, Financial Services, Management Consultancy and Oil.

Alongside his Chairmanship at Lowell, he is also a Trustee of WWF UK, Commissioner of the National Infrastructure Commission, a Senior Independent Director of Airtel Africa, Vice Chair of the Disasters Emergency Committee and Chairs the Risk Committee at the Link Group. -

Trond Brandsrud

Non-Executive Director

Trond Brandsrud

Non-Executive Director

Appointed: April 2019

- Experienced CFO, CEO, Advisor and Non-Executive Director with an interest in listed and private equity companies.

- Experienced Chairman of Audit and Risk committees.

-

Sally-Ann Hibberd

Non-Executive Director

Sally-Ann Hibberd

Non-Executive Director

Appointed: July 2022

- Highly experienced Non-Executive Director with a breadth of experience across diverse financial services industries; including insurance, banking, bancassurance, life assurance and investment management.

- Experienced ESG and Risk Committee Chair

-

Benoit Vauchy

Non-Executive Director

Benoit Vauchy

Non-Executive Director

Appointed: November 2020

- Partner, Permira with a strong private equity investment track record

Benoit has been involved with the Lowell Board since 2020. He brings a wealth of expertise in private equity leadership spanning JP Morgan through to his current membership of the Investment and Executive Committees at Permira. As well as Lowell, Benoit serves on the Boards of Universidad Europea and EDreams Odigeo, both in Madrid.

-

David Brueckmann

Non-Executive Director

David Brueckmann

Non-Executive Director

Appointed: August 2016

- Principal, Permira with an interest in the Services sector

-

Riccardo Basile

Non-Executive Director

Riccardo Basile

Non-Executive Director

Appointed: October 2022

- Operating Partner, Permira with expertise in operational transformation programmes

Riccardo has been involved with the Lowell Board since 2022. He brings significant experience in the delivery of supply change transformation programmes for PwC and five years delivering operational transformation programmes for AlixPartners. In his current role as Operating Partner at Permira he has been involved in several high-profile transactions including Tricor, Allegro, Axiom and Magento.

Like many of Lowell’s Board, Riccardo volunteers his breadth of financial skills as a Trustee. At present he is working with the UK charity Speech and Language UK.

-

.jpg?width=475&height=475&name=Cleo%20(1).jpg)

Cleo Cheung Goodman

Non-Executive Director.jpg?width=145&height=145&name=Cleo%20(1).jpg)

Cleo Cheung Goodman

Non-Executive Director

Appointed: January 2020

- Strong private equity experience and background

- Led several high-profile acquisitions and exits for global names

Managing Director, OTPP Private Capital

Cleo is a Managing Director at Ontario Teachers’ Pension Plan and leads origination, execution and management of direct investments in the financial services sector across Europe.She currently serves on the Board of 7IM (Investment Management) and Home Equity Bank in addition to Lowell. Cleo worked at CIBC World Markets in the M&A team prior to joining OTPP.

-

Gabriel Adebiyi

Non-Executive Director

Gabriel Adebiyi

Non-Executive Director

Appointed: February 2024

- VP, Permira with a focus on the Services sector

In his current role at Permira, Gabriel focuses on investment opportunities in the financial services and tech-enabled services sectors, and has been involved in a number of transactions including Motus. He worked at both Ares Management in the Direct Lending team, and at Deloitte in Transaction Services, each for three years, prior to joining Permira.

-

Elena Filekova

Non-Executive Director

Elena Filekova

Non-Executive Director

Appointed: July 2024

- Strong investment opportunities experience in EMEA

Director, OTPP Private Capital

In her current role at OTPP, Elena focuses on direct investment opportunities in EMEA across sectors. Elena worked as an investment professional at Sun European Partners for eight years and Goldman Sachs Investment Banking for four years, prior to joining OTPP.

Bonds

Garfunkelux Holdco 3 S.A.

€630,000,000

EURIBOR + 6.250% Senior Secured Notes due 2026

Interest payable Quarterly: February 1, May 1, August 1 and November 1 in each year, commencing

February 1, 2021

Settlement Date: 4 November 2020

ISIN (Reg S): XS 2250154494

ISIN (144A): XS 2250154817

Garfunkelux Holdco 3 S.A.

€795,000,000

6.750% Senior Secured Notes due 2025

Interest payable Semi-annually: May 1 and November 1 in each year, commencing May 1, 2021

Settlement Date: 4 November 2020

ISIN (Reg S): XS 2250153769

ISIN (144A): XS 2250154148

Garfunkelux Holdco 3 S.A.

£440,000,000

7.750% Senior Secured Notes due 2025

Interest payable Semi-annually: May 1 and November 1 in each year, commencing May 1, 2021

Settlement Date: 4 November 2020

ISIN (Reg S): XS 2250155467

ISIN (144A): XS 2250155541

Related Content

Read the latest announcements from Lowell.

Sustainability Reports

2023

2022

2021

Sign up to receive investor updates

Sustainability Reports

2023

2022