Sustainability drives every decision we make

We’re better for customers. We promote better ethics and understanding. We make things better for society. We manage our environmental impacts. We’re a responsible business.

What do we mean by Sustainability?

By sustainability, we mean the sustainability of our business. Without our Sustainability Strategy we would not be able to achieve our mission, to make credit work better for all, which acknowledges the far-reaching impact we have on wider society.

Sustainability runs through everything we do. Download our Sustainability Report.

Our Sustainability Strategy is structured around four pillars with clear ambitions and goals. We monitor performance using the metrics and data verification on our Sustainability Scorecard.

Sustainability reporting

Download our annual Sustainability Reports and Scorecards, Performance Scorecard, Sustainable Development Goals, and the SASB index, from our Reporting Hub.

- Better for Customers

- Better Ethics & Understanding

- Better for Society

- Responsible Business

- Environment

Better for Customers

We treat customers with respect and understanding. Personalised solutions and tailored support help them take control of their debt and build their financial understanding and wellbeing.

How we’re doing: sustainability snapshot from 2024

Better for Customers

- 2 million customers became debt-free with Lowell in 2024.

- Above-market NPS rates in DACH, Nordics and the UK.

- 96% of clients think we treat our customers in the right way (85%+ is 'excellent').

- Expanded communication channels in all regions, launching WhatsApp in DACH.

- Digital interactions have increased in all regions as we continue to develop our online offering.

- In the UK:

- Customers using our benefits calculator have identified £1.7m of unclaimed benefits since launch in 2022.

- App consistently rated in the top 10 financial services apps.

- Customer panel membership reached nearly 5,000.

- Scored 87.9 in the 2024 Institute of Customer Service Customer Survey (national average was 75.8).

See the 2024 Sustainability Report

See the 2024 Performance Scorecard

See the 2024 SASB Index

See our Reporting Hub for earlier reports, scorecards, and indexes.

How are we better for customers?

The data we capture from helping millions of people pay off their Lowell debts has given us unrivalled insights into debt’s impact on mental health, family relationships, and daily life. Combined with primary research, we use this powerful resource to inform our customer and client service offerings.

Our social aim of helping build customers’ financial understanding, rehabilitating them back into mainstream credit, goes hand-in-hand with our commercial objective of debt collection.

Customer insights from across the regions help us offer a more personalised service and digital journey, inspiring a range of local and topical support content on our websites that reflects various topics of interest to our customers (living with inflation, navigating the rising cost of living, and so on).

In the UK, we also provide online resources, signposting, an informative app, a benefits calculator, and free access to a credit score checker to help customers develop financial confidence.

We focus on customer affordability

When people are in problem debt, they face enough challenges without being asked to pay unreasonable amounts that they will struggle to afford. That’s why we make dealing with us as simple, straightforward, and stress-free as possible.

We help our customers find the ideal payment solution for their situation, so they leave us in a better position than when they arrived. This approach is not only better for customers but also supports our bottom line, driving a continuous and predictable income stream.

We know our customers inside out

We combine industry-leading insights from multiple data sources, including our 4,800-strong UK Customer Panel, to build a comprehensive picture of each customer’s situation, which helps us offer personal support and agree a mutually acceptable financial solution.

We give customers an industry-leading choice of channels

Our digital capabilities are amongst the best in the sector.

We continue to invest in digital technology, pioneering the deployment of an omni-channel approach in the debt collection sector. Our customers can access our services and support both digitally, through our app and online portal, and by calling our Customer Engagement Centre (CEC) to speak to a sympathetic expert agent.

They can move seamlessly between whichever channel they choose with confidence, knowing that we’ll help them reach the right outcome for them.

- Some people are uncomfortable talking about their debt and prefer being able to take control of their finances online. Our customers can manage their debt from start to finish digitally, without calling us at all.

- Customers in all our operating territories can now engage with us through interactive Live Chat.

- After learning that over 90% of German consumers were regular users of WhatsApp, we launched it as a channel in the DACH region in 2024.

- Usage of our digital channels continues to increase. In 2024, our digital enquiries process accounted for 26% of interactions in DACH, 66% of inbound customer interactions in the Nordics, and approximately 79% of engagements and 49% of collections in the UK.

- Our UK app reached half a million downloads in 2024 and now accounts for 42% of digital interactions in the UK. It consistently features in the top 10 financial services apps, with a 4.8 rating on the App Store and a 4 rating on Google Play (Feb 2025).

We encourage and value customer feedback

When it comes to listening to customers, we’ve found that the better we understand our interaction, the stronger the connection we can build with them.

Customer feedback

We capture customer feedback through various voice and online channels across our regions.

In the UK, for example, we use the data and insights captured in our world-class customer feedback platform, Medallia Experience Cloud, to inform business decisions, client reporting, and employee training.

The visibility of the customer experience that the platform offers also helps colleagues appreciate the positive impact their support has on customers.

The UK Customer Panel

We combine industry-leading insights from multiple data sources, including our 4,800-strong UK Customer Panel, to build a comprehensive picture of each customer’s situation, which helps us offer personal support and agree a mutually acceptable financial solution.

Amongst other things, we use the Panel to build our understanding of the circumstances that lead people into debt and its impact on their mental and physical health, and to test both the user experience of our digital offering and the effectiveness of our written communications.

We’re proud that our customers make a real difference to how we work, and we’re humbled by their commitment and enthusiasm.

Our Trustpilot score reflects the trust we’ve built with our customers: 85% of all ratings in 2024 were 4 or 5 stars.

Helping people and encouraging them to get help is the biggest incentive to do this for me. Just being there to help others. It’s worth 20 minutes of my time – even if it was longer, it would be worth it.

Member of UK Customer Panel

We look after Customers in Vulnerable Situations (CIVS)

Our research tells us that the main reason customers wait to engage with their debt is fear of the unknown (36%).

1-in-5 customers take over 12 months to engage with debt, with 31% of these stating ‘overwhelm’ as the reason. A staggering 82% said that waiting to engage with their debt had a negative impact on their mental wellbeing. This is why we try to start an open conversation with customers as soon as possible.

Our approach, combined with the increased openness to talk about wellbeing and mental health, something that’s estimated will impact half of the worldwide population, means the number of customers we’re recognising as being in a vulnerable situation is rising. In 2024 348,829 customers (about 5%) received additional support in the UK, up from 315,906 in 2023 (4%).

To ensure we’re offering an appropriately tailored service, our colleagues receive regular coaching and training on how to identify and support Customers in Vulnerable Situations (CiVS).

Groupwide, we stick to our eight public pledges to Customers in Vulnerable Situations, which are as relevant today as when we first published them in 2021. Our Executive Team and governance function are directly responsible for making sure we abide by them.

Read about our pledges for Customers in Vulnerable Situations (CIVS).

We help customers on the road to financial wellbeing

Better financial understanding helps to build greater resilience, so we support our customers with a set of sector-leading tools and services that’ll help them build their financial knowledge.

We help people check what benefits they’re entitled to

Every year, £23 billion of benefits in the UK go unclaimed. Our benefits calculator helps people check if they’re missing out on money that could help them get out of debt. And if they need support making a claim, we can signpost them to more resources from third party organisations.

Since launching the calculator in July 2022, we have found £1.7 million of unclaimed benefits for UK customers, averaging over £226 per customer.

We work with partner organisations to help people improve their financial health

In the UK, through our partnership with Snoop, we provide customers with a free money management app that helps them track spending, set budgets, and control finances.

We help people better understand their financial situation

We find that people are often unaware of the impact their credit score has when it comes to trying to access credit in the future. We offer free access to credit scores to help customers understand their finances. Used together with our debt calculator and affordability tools, customers can see how changes to their repayments can affect affordability and access to credit.

We provide online support and FAQs for people to help themselves

Each region has its own local support articles, signposting, and FAQs based on common regional queries and call drivers.

Our public commitments to Sustainability

We have aligned our Sustainability strategy with five UN Sustainable Development Goals.

.webp)

We have aligned our Sustainability scorecard with the Sustainability Accounting Standards Board (SASB)

We're committed to aligning our greenhouse gas reduction targets to the standards set by the Science Based Targets Initiative.

We're a signatory of the UN Global Compact, the world's largest corporate sustainability initiative, which calls on companies to align strategies with actions that advance societal goals.

Lowell was rated as Silver by EcoVadis ESG raters in 2025, placing Lowell in the top 15% of all companies EcoVadis rated during the year.

As a signatory of the Women in Finance Charter, our UK business pledges to support the progression of women into senior roles.

Better Ethics & Understanding

We aim to set the benchmark for ethical debt collection companies. We're using our size, scale and insights to advance standards and promote improved outcomes for all consumers.

How we're doing: sustainability snapshot from 2024

Better Ethics & Understanding

- Employer Value Proposition supports strong Group Colleague Engagement scores of 71+ for three years running.

- 87% Group Colleague Engagement survey response rate.

- 7-year average colleague tenure.

- 100% of eligible employees completed our Group Code of Conduct and People Policy training.

- Our Group Client Satisfaction score of 8.2 confirmed our status as a trusted partner.

- Long-standing client relationships: 13-year average tenure of DACH and Nordics clients; 55% of UK deals in 2024 were 'long-term'.

See the 2024 Sustainability Report

See the 2024 Performance Scorecard

See the 2024 SASB Index

See our Reporting Hub for earlier reports, scorecards, and indexes.

How are we promoting better ethics and understanding?

Lowell isn’t just another debt company, it’s an ethical company that strives to make credit work better for all.

Our research ability, advocacy, insights, and data are in line with those found in mature international financial services companies. This is a key strength relative to our peers. Naturally, we focus on retaining our own high standards, colleague, customer, and client relationships. We’re also a strong voice calling for improvements to debt collection standards more broadly. We’re determined to stamp out the stigma of debt. And we’re passionate about improving financial inclusion across society, helping to bring stability to the lives of the most financially vulnerable.

We stick to our Values and follow our Mission

Generating and keeping trust has always been vital in our industry. We earn it by aligning the way we work with our Mission and Values, and by delivering on our Employer Value Proposition (EVP).

Our Mission is written into a set of policies and operating procedures detailing how we run our business, engage with stakeholders, manage risk, and make decisions.

Our Values and EVP are a promise to our colleagues, who bring our Values to life every day through their positive and professional approach. Their understanding of the complex and challenging issues caused by debt, helps us keep hold of the trust people put in us.

We stand out to colleagues

A record 87% of colleagues completed our 2024 colleague survey. Our colleague engagement score was 71. 86% of colleagues confirmed that they understood how their work contributed to Lowell’s success and 73% said their work was meaningful to them.

Lowell UK featured in the Sunday Times Best Places to Work in 2024. After joining the Institute of Customer Service we also took part in their annual UK Customer Service survey, scoring 87.9 for customer service – well above the national average of 75.8. Our colleagues rated our customer service performance at 81.76.

We stand out to clients

We work closely with our clients, going beyond regular business interactions to share our insights and improve understanding. The insights we gain from our clients about our customers don’t just help us improve our own customer journeys and service; they also influence how our clients treat their customers before they get into problem debt.

We also provide our clients with regular access to our subject matter experts.

The average tenure of our largest clients in DACH and the Nordics is 13 years, with our longest-standing Nordic client relationship dating back to the 1980s. In the UK we track a world-class client NPS score of 76 and 55% of our 2024 debt purchases were on long-term arrangements.

Respondents of our 2024 annual client survey called out our clear communication, positivity around sharing best practice, flexible customer-focus, and industry knowledge and experience as drivers of their strong likelihood to recommend Lowell.

Leadership presence on trade bodies and associations in every country we work in

We have a strong leadership presence in all major trade bodies and associations in DACH, Nordics and the UK.

We’re an affiliate member and sponsor of the Federation of European National Collection Associations (FENCA). Our DACH COO, Anke Blietz-Weidmann, is the elected president of the Federal Association of German Debt Collection Companies (BDIU). We’re members of associations for Finnish, Danish, Norwegian, and Swedish debt collection companies, and the Association of Trade Services in Norway.

Our UK Lowell Financial Managing Director, Kathryn Morgan, is a Board Director at the Credit Services Association (CSA). Our UK CEO, John Pears, sits on the advisory panel for the Centre of Social Justice (CSJ). In the UK we joined the Institute of Customer Services in 2024.

We help fund free independent debt advice in the UK

We’re members of the Money Advice Trust’s Vulnerability Academy and the Collaboration Network, which help fund the UK’s free debt advice sector. In 2024, we contributed £4.2 million through Fair Share contribution, helping to make free independent debt support available to those in need.

We’re calling for improvements

We take a prominent leadership role within our sector, working closely with peers and regulators to set standards for fair collections, develop codes of conduct for the industry, and influence policy makers through our wide-ranging research and unrivalled data gathering abilities.

Unique amongst our peers, our research ability, advocacy, insights, and data are in line with those found in mature, international financial services companies. As a Group, we have over 15 million customers.

We’re using our leadership status to tackle the stigma of debt

People struggling with problem debt often feel a sense of shame and embarrassment.

We believe this is unfair and unwarranted, which is why we’re working with clients, partners, and charities to rehabilitate the image of debt and to help improve the understanding of the impacts of our industry. Our aim is to improve the financial health of customers and colleagues, and to have a positive impact on consumers by influencing standards and regulation.

Lowell UK’s Manifesto calls for ‘Fairer Debt, Fairer Society’

We believe pragmatic reforms to the financial sector could both help ease the pressures on families dealing with debt and lay the groundwork for a better financial future. This is the premise behind

the three asks of our manifesto, launched in 2024.

Find out more about our three asks Lowell Manifesto 2024.

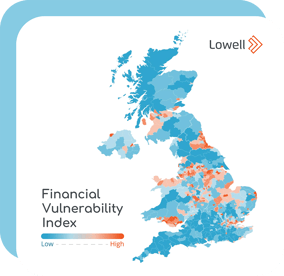

We run the UK’s first Financial Vulnerability Index

Since launching the innovative FVI in 2021, we’ve used it to measure and track financial resilience across the UK, nationally and locally. It brings together publicly available measures and Lowell’s proprietary data to paint a clear picture of financial vulnerability in the UK, giving users valuable insight into the financial health of people across the country.

Alongside other research, this data supports our activities lobbying for improving school and workplace financial education, and for the introduction of a Minister for Financial Inclusion.

Go to the Financial Vulnerability Index

We’re supporting better financial education for our colleagues

Financial education is relevant to everyone: our colleagues, customers, and for wider society.

Working alongside our charity partner MyBnk, we have incorporated financial education, mental health, and resilience into our UK Collections Level 2 Credit Controller Collections apprenticeship programme. This initiative not only benefits our new colleagues personally, it equips them with the skills and insight to support and empathise with our customers.

Lowell’s Nordic Manifesto calls for consistency in public policy

Our Nordic Manifesto argues that public policy should deliver the following outcomes consistently across all Nordic countries:

- a common national debt register (or a positive credit information register);

- include personal finance in the curriculum for secondary schools and better advice for the public in general;

- municipalities and welfare regions should not collect customer fees from those who are unable to pay;

- a voluntary blocking service for new consumer loans; and

- break the silence around financial distress.

Across the Nordic region, we continue to promote steps towards such outcomes with, for example, specific client support, simpler language in letters to customers about debt recovery, and an educational guide about the credit cycle for teachers in secondary schools.

Our public commitments to Sustainability

We have aligned our Sustainability strategy with five UN Sustainable Development Goals.

.webp)

We have aligned our Sustainability scorecard with the Sustainability Accounting Standards Board (SASB)

We're committed to aligning our greenhouse gas reduction targets to the standards set by the Science Based Targets Initiative.

We're a signatory of the UN Global Compact, the world's largest corporate sustainability initiative, which calls on companies to align strategies with actions that advance societal goals.

Lowell was rated as Silver by EcoVadis ESG raters in 2024, placing Lowell in the top 15% of all companies EcoVadis rated during the year.

Better for Society

We put people first. We work towards creating a stronger society by fostering better financial wellbeing, promoting inclusive work opportunities, and providing support for our communities.

How we’re doing: sustainability snapshot from 2024

Better for Society

- Shared insights from consumer research keeps the conversation going about debt and reached over 5 million people.

- Our colleague engagement survey score for being ‘happy’ at work is 73 for the second year running.

- 80% of colleagues believe everyone at Lowell has equal opportunity to succeed, regardless of their background.

- Our DEI was externally assessed as ‘Leading’

- We achieved our target of 40% female representation in the senior team a year before our December 2025 deadline.

- Around 300 colleagues used almost 1,300 paid volunteering hours to support causes in our local communities.

See the 2024 Sustainability Report

See the 2024 Performance Scorecard

See the 2024 SASB Index

See our Reporting Hub for earlier reports, scorecards, and indexes.

How are we better for society?

We’re not just determined to help people move out of debt, we want to use our position, insight, and influence to help create a stronger society. We believe that by promoting financial wellbeing, providing inclusive employment opportunities, and pitching in with our communities, we can help build a strong, resilient business and a fairer society.

We’re helping people better understand debt

We’re expanding awareness and understanding of debt within society, helping to grow people’s financial knowledge and skills.

Normalising the conversation about debt with a call to be proactive

We want to take the stigma out of the ‘D’ word. As well as bringing debt issues out into the open and championing financial education, we see an essential element of our role as ensuring that people struggling with debt know that they are not alone.

We continue to run campaigns designed to encourage conversation about debt and to give people practical hints and tips about how to weather the financial storm, reaching over 5 million consumers in 2024.

In a year where requests for debt repayments breaks rose by 25%, research in the UK confirmed that debt negatively affected the mental health of 8-in-10 people. Our Proactive About Debt campaign encouraged people to talk more about their debts after identifying that only 20% of people in our survey felt empowered or in control when talking about their financial situation: men (31%) are more likely to feel comfortable talking about their financial situation than women (19%).

In the Nordics, a podcast on over-indebtedness from our Communications & Marketing Director, Fredrik Skärheden, and Legal Counsel, Christoffer Thorell, continued to offer practical tips and advice in response to consumer insights.

Enduring partnership with the Centre of Social Justice

Our partnership with the Centre for Social Justice (CSJ) continues with UK CEO, John Pears, now sitting on their Advisory Panel.Throughout our three-year relationship - based on an alignment of organisational priorities and policies - we have helped to fund their Debt Unit. We work together on various initiatives, including helping people with problem debt and improving the state of the UK economy.

In 2024 our ‘Still Collecting Dust’ report focused on public sector collection standards and found:

- Fewer households are falling behind on council tax now, but the households that do are poorer and the amount they owe in arrears is larger.

- Households in council tax arrears struggle to pay their bills. Those behind on their council tax have an average of just £148 a month to live on after housing, food, and energy costs.

- Local authorities with high levels of income deprivation have higher levels of enforcement (bailiff) activity, yet lower levels of council tax collection.

These findings further fuelled our Fairer Debt, Fairer Society manifesto asks in relation to local authority debt collection.

Financial education packs for schools in the Nordics

Our Nordic Manifesto advocated public policy and action on a common national debt register, personal finance in the curriculum for secondary schools, and better advice for the public in general. We continue to provide printed education packs and teacher support guides for schools in Denmark, Sweden, and Norway, alongside digital versions and ‘train the teacher’ sessions.

All systems go for development and wellbeing

We believe that offering a great place to work, where Colleagues feel valued and can thrive, isn’t just a good thing in itself: it’s the best way to attract people with the right skills and cultural fit.We continue to invest in the development of our team, something we know improves job satisfaction, happiness, and overall engagement. We complement on-the-job coaching and support with a structured

approach to development that nurtures talent, strengthens succession planning, and helps Colleagues achieve their ambitions.

Activities in 2024 included:

- Learning & Development Hub – a new one-stop-shop for information on our colleague offering.

- Apprenticeships – we have over 50 active apprenticeships across the Group. We also share our UK apprenticeship levy across our supply chain to support under-represented talent.

- Let’s Go – our people manager programme combines practical management skills with self-awareness and reflection. 70 leaders completed the programme in the UK; 45 leaders are mid-way through in the Nordics.

- The ‘Grow’ programme – self-serve career development programme combining workshops, drop-in sessions, podcasts, and seminars to help Colleagues take control of their own development.

- Mental health masterclass – completed by 150 UK people managers in 2024 to equip them with the knowledge, skills, and tools to support their own mental wellbeing and that of their teams.

- Talent programme – focused on identifying and supporting top talent to reach their full potential.

We’re building a welcoming, inclusive, and diverse community

We invest both time and money in our mature DEI agenda, based on the belief that diversity of thought is essential to our success and to driving engagement.

In 2024, 81% of Colleagues believed that, regardless of background, everyone at Lowell has an equal opportunity to succeed.

During 2024 we partnered with external advisors to assess our DE&I maturity. We scored 11 percentage points above the benchmark, which placed us in the ‘Leading’ maturity category.

In terms of governance, our DE&I Council is supported by a network of Colleague ‘Involve’ groups in each region for local action.

We believe that - to build an inclusive organisation – we must be able easily hear Colleagues. Our DEI networks have continued to evolve, with the remit to support those who identify with the network, help us to identify bias or discrimination that might prevent progression or inclusion, champion change, and support the roll out of initiatives, which in 2024 included:

- Celebrating days across the spectrum of characteristics, including Pride, Cultural Diversity, World Mental Health Day, and religious festival celebrations.

- Development of unconscious bias training.

- Ongoing review of people policies and revising pension to be Sharia-law-compliant.

- Partnership with the Workeer job platform in DACH for refugees and newcomers to the region.

Equity is about creating a level-playing field, not treating everyone the same way.

In 2024 our focus continued with a Colleague campaign to build understanding; the launch of a new Groupwide Recruitment Steering Group to identify and remove bias; and the launch of our Pay Equity Project, which aligns to the EU Pay Transparency Directive requirements.

Female representation target achieved

Back in 2021 we set a target to achieve 40% female in our senior team by the end of 2025.

This target aligned to recommendations from the Hampton Alexander Review back in 2021, that identified 40% as the minimum threshold to avoid under representation. We started from a baseline of 33% female representation in our senior team in 2021. Following a determined effort to improve the diversity of our talent pipeline, remove barriers and support female talent, we had 42% female representation in our senior team by the end of 2024.

We remain focused on this and will continue to identify and remove any legacy gender barriers by changing our policies on maternity (and parental) pay and conditions, reward, and part-time working. We also remain committed to extending our targets beyond gender diversity: the collection of personal characteristics in the UK is a key enabler for this.

Find out what CPO Bitte Ferngren thinks about our gender representation target [LINK]

DEI involves sub-groups focused on Gender, Disability, Neurodiversity, Culture and LGBTQ+

In the UK, three sub-groups have developed.

SPARK, our disability and neurodiversity group

Launched with an event featuring award-winning disability blogger Chloe Tear and her guide dog Dezzie, the network generates lots of ideas and signposts changes made in response to colleague feedback, including adjusting the fire alarms in toilets, removing fierce strobe lighting, and display screen equipment (DSE) adjustments.

RISE, our network for women and allies

Focused on resilience, inspiration, support, and empowerment the network seeks to create a supportive environment where women feel valued and connected, can share experiences, and learn strategies for success. It’s about more than professional development and networking; it’s about finding a route to a more rewarding career. Topics during 2024 included addressing the question ‘Can women have it all?’ and exploring the advice you would give to your younger self.

UK Culture Network explores the differences that bring us together

A network based on learning from each other to help shape Lowell’s inclusive culture. Sessions have focused on sharing experiences and tips like reframing challenges and using questions to build understanding. A key theme of early sessions was unconscious bias, which led to the development of a new programme at Lowell.

Giving back to the community

We believe we have a responsibility to the communities we serve.

Our colleagues have a keen sense of wanting to do good. For many of us, working for Lowell isn’t just a job, it’s a way we can do something important – to help make life better for people going through a tough time.

We also contribute to the wellbeing of our communities

We encourage and support volunteering wherever possible, giving our colleagues across the UK, DACH, and the Nordics regions an annual (paid) Volunteering Day when they can support the causes they care about. Around 300 colleagues used their day in 2024, giving almost 1,300 hours. It’s all part of our mission: to make credit work better for all. As a business, we also donate to various charities, including matching funds raised by colleagues.

These include organisations that:

- Supply financial education services.

- Help people get out of poverty.

- Care for the homeless.

- Provide food parcels.

- Support people with mental health issues.

Our public commitments to Sustainability

We have aligned our Sustainability strategy with five UN Sustainable Development Goals.

.webp)

We have aligned our Sustainability scorecard with the Sustainability Accounting Standards Board (SASB)

We're committed to aligning our greenhouse gas reduction targets to the standards set by the Science Based Targets Initiative.

We're a signatory of the UN Global Compact. The world's largest corporate sustainability initiative, which calls on companies to align strategies with actions that advance societal goals.

Lowell was rated as Silver by EcoVadis ESG raters in 2024, placing Lowell in the top 15% of all companies EcoVadis rated during the year.

We're a Responsible Business

We protect our business, people, customers, clients, and communities through strong governance, sustainable business practices, and robust risk management.

How we’re doing: sustainability snapshot from 2024

Responsible Business

- Board-level oversight of key topics including Remuneration, Risk, Audit and Sustainability.

- Double Materiality Assessment confirms continued relevance of our sustainability strategy

- 100% of colleagues completed training on data security, protection, and privacy.

- 100% of colleagues completed training on anti-bribery and corruption policies and procedures.

- Our Executive and senior leadership colleagues each have a performance objective, linked to remuneration, to support our Sustainability and Diversity, Equity and Inclusion agenda.

- Developed robust Group-wide approach to artificial intelligence (AI).

- First Consumer Duty report completed in the UK.

- Enhanced supplier oversight on environment and human rights topics.

See the 2024 Sustainability Report

See the 2024 Performance Scorecard

See the 2024 SASB Index

See our Reporting Hub for earlier reports, scorecards, and indexes.

How are we a responsible business?

As you would expect from Europe’s leading credit management company, we uphold the highest standards of risk management, corporate governance, and ethical conduct. We’re at the forefront of a highly regulated industry.

Governance

You’ll find our full governance framework and descriptions of all our Board Committees on our Governance page along with information about our approach to risk management, data protection, and other policies and procedures.

Sustainability Development Group

The SDG is responsible for all aspects of our sustainability strategy, from recommendations for the strategy and its development, through to delivering, embedding, and communicating it. Our Group Head of Sustainability chairs the SDG. The SDG reports to the Group Executive Committee.

Group Sustainability Committee

The GSC is a stand-out instrument of governance in our sector. Chaired by a Non-Executive Director, it gives strategic advice, leadership, and challenge to the Board about Lowell’s sustainability agenda and combines external oversight with internal expertise.

The committee was actively involved in our Double Materiality Assessment in 2024. The very existence of this committee demonstrates the importance Lowell places on Sustainability, alongside other topics with Board-level oversight, remuneration, risk, and audit.

Reviews of regulation and reporting

We continuously monitor regulations to stay compliant.

In 2024, we completed audits across our offices as required by the EU Energy Efficiency Directive and completed some initial preparations for the Corporate Sustainability Reporting Directive (CSRD), which may apply to Lowell in the future. This included a detailed Double Materiality Assessment to identify key sustainability impacts, risks, and opportunities. We are also aligning with the EU Taxonomy Regulation, which will apply in 2025.

From a reporting perspective we continue to align our reporting to the SASB framework, which we chose based on investor feedback and its sector focus.

We also align our efforts with five UN SDGs (1, 5, 8, 13, and 17). As signatories of the United Nations Global Compact since 2022, we submitted our first Communication of Progress in 2024.

Our approach to risk

Our Group Risk Framework and Risk Appetite guide our approach to risk management, supported by various policies. Our Risk Library helps us identify, understand, and manage risks. The relevant risk owner reviews each of Lowell’s risks annually to ensure controls are always effective.

To make sure we align to our Group Risk Framework and our appetite for risk, we organize our risk management using the Three Lines of Defence model. Each line has clearly defined roles, responsibilities, and accountabilities.

A three-lines-of-defence model anchors our risk strategy:

Download more information about our approach to risk.

An intelligent approach to AI governance

Like most companies, we’re keen to explore the opportunities and benefits that AI presents. But we’re also cautious about its deployment: robust governance is essential, which is why we’ve established a governance structure that puts safety first while embracing innovation.

Recognising variations in the regional needs and appetite for AI, we’ve developed regional policies to guide our approach to a technology that’s evolving at a breathless pace.

We’ve given responsibility for AI policy implementation to our Regional Chief Information Officers and Risk Officers. Our standard operating procedures align with the relevant regional policy, reflecting local

business demands and regulations. Our approach also extends to our third-party suppliers and providers: we’re currently adapting our supplier assessment so that it mirrors our AI principles and standards.

Consumer Duty in the UK

Following the introduction of Consumer Duty regulation in the UK in 2023, Lowell UK completed its first UK Consumer Duty Report in 2024. The 56-page report included an overview of our business, and sections on our products and services, customer understanding, delivering good outcomes, price and value, and customer support.

The bespoke report was produced in-house in line with FCA guidance. Our aim was to give an open and balanced view of our business – showcasing our strengths while also sharing areas of continuous improvement, directed by the Consumer Duty Principles.

Business ethics in action

We have a series of policies – with performance tracking in place – to support high standards of ethical conduct:

Group Code of Conduct

Our Code of Conduct sets out the ethical standards we expect, and the behaviours we encourage, across the business. It is updated every two years, to reflect current regulation and incorporate any new policies.

Human Rights policy

Developed in 2024, our Group Human Rights policy sets out how we promote and respect human rights within Lowell and across our business activities. It brings together topics that were previously within existing policies, including labour management, our approach to social dialogue on issues such as employee safety and freedom of association, and our compliance record with regional laws, legislation, standards, and collective agreements.

We created the policy in partnership with an external human rights specialist. It reflects regulatory requirements, best practice, and international human rights standards, including:

- International Labour Organisation’s (ILO) Declaration on Fundamental Principles and Rights at Work

- International Bill of Rights

- UN Global Compact Principles

We see risk as a connected system across our business, our customers, our partners and the wider world – we’re striving to build a resilient business while addressing broader challenges such as social vulnerability and climate change.

Eva Eisenschimmel, DACH CEO

Data security, protection, and privacy

We cover this across a range of Group and regional policies. Each region has its own Data Protection Officer and a dedicated Information Risk team to make sure we meet our data protection obligations. All colleagues undertake annual mandatory training with 100% of eligible colleagues completing it in 2024.

Read more about our data protection and information security.

Cyber security

Cyber-attacks are a constant threat. Regional cyber-threat experts manage this, overseen by the Regional Chief Risk Officers with a member of the Executive Management team leading the strategy.

We handle cyber and tech risks through our Information Security Management System (ISMS), with policies regularly reviewed by senior management. Regular reports on cyber risk management are shared with Risk Committees and Group Exec for review and approval.

In the UK, our Information Security Management is accredited to ISO27001.

Financial crime regional policies

We give annual mandatory training to all colleagues, so they are aware of their compliance and regulatory obligations, and risk-based best practice. In 2024, 100% of eligible colleagues completed this training.

Gifts, hospitality, conflicts of interest

Our Code of Conduct training covers a variety of ethical situations. It’s supported by local policies and procedures.

Whistleblowing

We actively promote a culture where Colleagues feel free and safe to speak up about any concerns. They can raise their concerns and tell us what they’re thinking through both formal and informal channels, fully confident that we will hear their voice. Our Group Whistleblowing policy is available on our intranet. It sets out the formal and informal options available to colleagues wanting to raise issues anonymously and confidentially.

Third-party management

Responsibility for supplier management oversight sits within our regions, with subject-matter experts handling individual relationships.

In 2024, we sharpened our focus on sustainable procurement and supply chain risk through a new Group Procurement Policy, Supplier Code of Conduct, and enhanced risk assessment, covering environmental, human rights, and labour issues. We also completed Colleague training on the new policies, sustainability monitoring, and financial and compliance checks covering performance, politically exposed persons, sanction screening and negative media exposure screening.

Group Supplier Code of Conduct

Our Supplier Code of Conduct forms part of our Terms and Conditions, which all Lowell suppliers must agree to before working with us. Guided by regulation, we have a steady focus on human rights issues in our own organisation and within our supply chain.

Anyone who wishes to raise any concerns about human rights or environmental protection within Lowell or our supply chain can follow our complaints procedure.

Our public commitments to Sustainability

We have aligned our Sustainability strategy with five UN Sustainable Development Goals.

.webp)

We have aligned our Sustainability scorecard with the Sustainability Accounting Standards Board (SASB)

We're committed to aligning our greenhouse gas reduction targets to the standards set by the Science Based Targets Initiative.

We're a signatory of the UN Global Compact. The world's largest corporate sustainability initiative, which calls on companies to align strategies with actions that advance societal goals.

Lowell was rated as Silver by EcoVadis ESG raters in 2024, placing Lowell in the top 15% of all companies EcoVadis rated during the year.

Environmental Impact

We’re committed to doing what we can to manage our impact on the environment and tackle climate change. Our Sustainability Strategy embeds environmental protection throughout our business.

How we’re doing: sustainability snapshot from 2024

Environmental impact

- We’ve cut Scope 1 and 2 and business travel emissions by 78% since 2019, surpassing our target of 65% reduction by 2025.

- Business travel policy implementation resulted in a 34% reduction in emissions from business travel compared with 2023.

- 59% of Lowell's electricity sourced from renewable sources in 2024 on an annualised basis; 99% of Lowell’s office space was on renewable tariffs by the end of 2024.

- Achieved a more accurate view of our Scope 3 emissions in 2024 by using regional rather than global emission factors.

- In the UK, we do not send any waste to landfill.

See the 2024 Sustainability Report

See the 2024 Performance Scorecard

See the 2024 SASB Index

See our Reporting Hub for earlier reports, scorecards, and indexes.

How are we managing our impact on the environment?

We’ve developed our greenhouse gas emissions goals in line with the requirements of the Science Based Targets initiative (SBTi) to make sure we’re aligned to the latest climate science. We are awaiting validation of our targets.

You can keep up to speed with our progress in our annual Sustainability Report.

Our climate goals

We re-set our climate goals in August 2023 and committed to the Science Based Targets initiative. We will:

- Reduce operational emissions by 65% (from the 2019 baseline) by 2025 for Scope 1 and 2 emissions and from business travel.

- Offset emissions to hit carbon neutral for Scope 1 and 2 emissions and from business travel from 2025.

- Use 100% renewable electricity in all offices by 2025.

- Cut emissions in our value chain by a ‘significant’ amount – within the SBTi guidelines – during the next 5-10 years. We will publish this ‘near-term’ target by the end of 2025.

- Agree a 'long-term target' to reach the SBTi Net Zero standard by 2040, which we’ll publish by the end of 2025.

What do we mean by Scope 1, 2, and 3 emissions?

These are the standard categories of emissions that companies create in their own operations and through their value chain.

- Scope 1: this covers all the emissions that a company makes directly, like those from company cars and emissions from manufacturing processes.

- Scope 2: indirect emissions like heating and electricity, which the company doesn’t produce itself.

- Scope 3: the emissions that a company is indirectly responsible for, like the goods and services we buy, colleagues commuting to the office, and so on throughout the value chain.

Our five-point plan for emissions reduction

We have a plan to reduce our Scope 1 and 2 emissions:

- Switch to 100% renewable electricity across all our sites by 2025.

- Exploit energy efficiency opportunities on high-emission sites with long-term lease commitments.

- Optimise office space for hybrid working.

- Insist all new sites come with green credentials.

- Remove all internal combustion engine vehicles from our fleet by 2030.

Operational emissions

Operational emissions include Scope 1, Scope 2, and business travel. We aimed to reduce Lowell’s operational emissions by 65% by 2025 (based on 2019 levels) to ensure absolute carbon reductions before offsetting emissions for carbon neutrality in 2025.

We’re pleased to have achieved this operational emissions reduction early, cutting greenhouse gas emissions from office energy and business travel by 78% (since 2019) in 2024. Key measures included switching to renewable electricity and implementing a business travel policy that prioritises lower-emission transport.

We will identify suitable carbon offsetting options during 2025 and continue exploring further opportunities to reduce operational emissions as part of our net zero ambition.

Switching to 100% renewable electricity across all our sites by 2025

Switching to renewable sources of electricity is an important step in reducing our emissions.

We’ve made good progress during the year, increasing the proportion of electricity from renewable sources by 9 percentage points to 59%. By the end of 2024, we had placed 17 of our 19 office spaces - representing 99% of our floorspace - on renewable electricity tariffs.

Emissions in the value chain

To reduce our value chain emissions, we’re preparing to monitor supplier emissions, include environmental criteria in supplier selection, and enable colleagues to use low carbon transport for their commutes.

We initially worked on a full inventory of our Scope 3 GHG emissions data for 2023, covering all categories relevant to our business activities, including purchased goods and services, capital goods, and employee commuting.

In 2024 we worked on improving the accuracy of our footprint by using regional rather than global average emissions factors wherever possible. As a result, 2023 and 2024 are not comparable. Our current focus is on engagement with our latest suppliers, reviewing the volume of paper we use and send to customers, and reviewing the public transport options available to our Colleagues when travelling to work.

Engaging colleagues on environmental issues

Formed in June 2022, our Environmental Involve Group (EIG) consists of Colleague volunteers who want to put their personal passion for environmental topics to good use in helping the planet.

The EIG’s remit is to be a critical friend for our environmental work, helping to shape our corporate agenda and to generate interesting and informative content to help Colleagues make more informed choices in their personal life.

Waste

In the UK, we’ve already achieved our goal of sending no waste to landfill.

We’re now looking at how we can introduce sustainable waste management, which will include regular waste audits, the enthusiastic participation of our Environment Involve group of Lowell volunteers, and reducing our use of paper.

Our public commitments to Sustainability

We have aligned our Sustainability strategy with five UN Sustainable Development Goals.

.webp)

We have aligned our Sustainability scorecard with the Sustainability Accounting Standards Board (SASB)

We're committed to aligning our greenhouse gas reduction targets to the standards set by the Science Based Targets Initiative.

We're a signatory of the UN Global Compact. The world's largest corporate sustainability initiative, which calls on companies to align strategies with actions that advance societal goals.

Lowell was rated as Silver by EcoVadis ESG raters in 2024, placing Lowell in the top 15% of all companies EcoVadis rated during the year.